There are many ways you can exchange money when studying/living abroad. The issue is finding the way to get the most bang for your buck. If you’re looking to save money when converting, check out my experience with Transferwise.

As some of you may know, I’m an American living in Spain. And since I’m on a student visa, it’s not possible for me to work full-time and make tons of euros.

So, I have to take my US dollars and put them in my Spanish bank account…and that money gets used up. Quickly. Meaning I have to exchange more money to be able to live over here.

Recently, I’ve had a few experiences exchanging money…and some are just ridiculous. So I’ve decided to share with you the BEST way I have found so far: Transferwise.

The affiliate links in this post help me continue to do what I love.

Read my disclaimer to learn more.

What is Transferwise?

Simply put, Transferwise is an amazing company that allows you to send currency from one bank account/credit card, to a foreign bank account with a different currency (e.g. US dollars from a Bank of America account, to euros with a Banco Santander account).

But why is Transferwise so amazing?

Transferwise has been my lifesaver recently because:

- They exchange money at the real exchange rate (the rate you find on Google)

- They quickly complete the transfer

- They have super low commission fees (and are 100% transparent about them)

- Their website is super easy to use

- You can get your first $500 transfer free

So let’s break these points down a bit:

They exchange money at the REAL exchange rate

I currently have $1000 USD in bank notes with me, but I never exchanged them because I didn’t want to lose money when converting.

However, last week, I was running low and needed to change my money to euros. So I went around to about TEN different currency exchange companies on Las Ramblas in Barcelona…BAD IDEA.

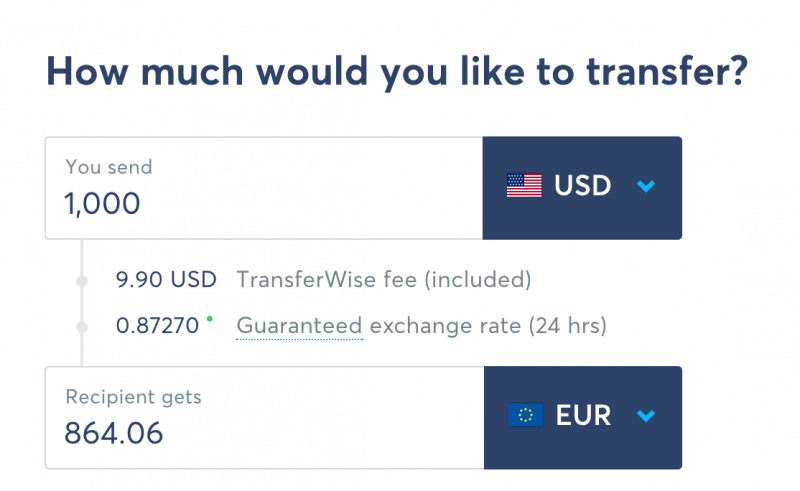

With the REAL exchange rate at 0.8727 USD to EUR, I was supposed to get 872€ for my $1000. However, not one company wanted to be this generous.

The lowest offer I got was 710€… That’s 162€ LESS than market price!

Out of all of the places I went to ask, the best offer I got was 803€ for my $1000. Ok, better…but still 69 euros less.

But then! I remembered I have an account with Transferwise…the lifesavers.

Before making any rash decisions, I decided to go home and check how much I would get online. Transferwise was offering me 864€.

Now, you’re probably thinking, you were supposed to get 872€ not 864€. However, they charged me a small fee for the transaction because I already used up my free transfers.

But either way, losing out on 8 euros is 100% fine with me! That’s SO much better than losing out between 69 and 162 euros, right?!

They quickly complete the transfer (1-2 business days)

On top of giving me a great rate, they also transfer the money quickly!

It usually takes them 1-2 business days to get the money from one account to the other (with a guaranteed exchange rate at the moment you submit the transfer).

However, since I’m technically nine hours ahead (thank you time difference!), my money comes in literally THE NEXT DAY. I’m telling you…LIFE SAVERS.

They have super low commission rates

I mentioned they charged me a teeny tiny commission for the transaction. But this is literally REALLY tiny.

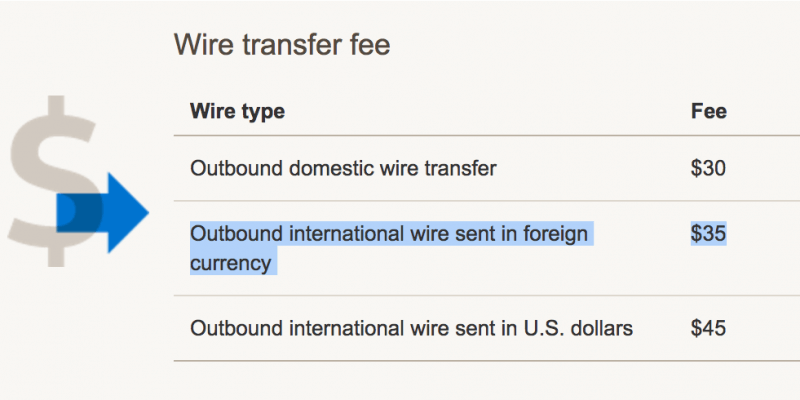

I have Bank of America back home, and when I sent money to my Spanish landlord for my apartment deposit, I got ripped off. Badly.

Not only did my bank already mark up the exchange rate to get profit out of it, but they also charged me $35 to SEND the money over. AND on top of that, my landlord showed me that 25€ were taken out of the transfer…meaning I had to pay an extra 25€. Ridiculous. Anyway, now that you see how much money companies get out of converting your money (even your own bank), you can see that Transferwise’s 1% (or less) commission fee is totally reasonable.

Anyway, now that you see how much money companies get out of converting your money (even your own bank), you can see that Transferwise’s 1% (or less) commission fee is totally reasonable.

AND you can get your first $500 transfer for free

Ok, I’ll be honest, when I first signed up it said I only had one free transfer, yet they gave me three fee-free $500 transfers…So I’m not sure if you will get one or three.

But either way, it’s worth it! I have used them five times already and can’t believe I even considered going to one of the money exchange booths in the center of the city.

(UPDATE April 2018: If you need to send more money, try playing around with the site. My Brazilian friend was able to convert her Brazilian reais for $725 USD without a fee!)

BUT, it’s not for everyone, as it requires you to send money to a bank account in the foreign country.

So, who is Transferwise for?

- Students studying abroad

- People living abroad with a foreign bank account

- People who conduct international business

- People who send/receive money internationally to/from family members or friends

- Or people traveling abroad who have friends living in that specific country

Whenever my friends visit me from overseas, I always tell them to use Transferwise and send money to my account instead of bothering with any other currency exchange method.

They’re always surprised by how much they save, and I feel like Superwoman saving them money.

Aren’t they amazing?

(UPDATE April 2018: I’m also using Transferwise for my working holiday trip to Australia. I’m absolutely in love with this company guys! AND I recently discovered their Borderless Account feature which is super cool! Maybe I’ll do a post on that later…for now, if you’d like more information on their Borderless Account, check here.)

I hope this post helps you save a ton of money when traveling or living abroad.

If you can’t send the money to a foreign bank account, check out other ways you can use your money while abroad.

Have you ever used Transferwise? How do you exchange money when you’re traveling?

Related posts:

- Top Airport Tips: Travel like a Pro

- The Ultimate Guide to Booking Cheap Flights

- Applying for a Work and Holiday Visa – Australia

- Five Ways to get Currency for a Trip

Favorite Travel Resources:

This is such a helpful post! I always struggle with getting the most money when exchanging currencies. Plus you have a Polish note in your photo at the very front so automatically this is already my favourite post on the Internet 😀